Tax Loss Harvesting

for NFTs & Tokens

Sell your worthless jpegs and tokens for 1 gwei.

Offset your gains. Keep more of your profits.

Welcome to the Farm

Whether offloading junk or bidding on auctions, we hope y'all enjoy your stay.

Multi-Chain Support

Harvest losses across the most popular EVM chains

Don't miss the Harvest.art theme song

By our friend and legendary song-a-day artist Jonathan Mann

By @songadaymann — and yes, we own the NFT.

How Tax Loss Harvesting Works

Turn your worthless assets into tax savings in three simple steps

Connect Wallet

We'll scan your NFTs and tokens across all supported chains automatically.

Sell Your Junk

Select up to 500 unwanted assets and sell them to us for 1 gwei each.

(Just pay a small service fee.)

Offset Gains

Use your realized losses to offset gains and reduce your tax liability.

(But talk to your CPA first.)

Before Harvesting

After Harvesting

* Hypothetical example. Always consult a tax professional.

Understanding Tax Loss Harvesting

What is it?

Tax loss harvesting is a strategy that allows investors to offset capital gains by selling assets at a loss. This can potentially lower your overall tax liability.

How does it work for NFTs & Tokens?

You can sell worthless or illiquid NFTs to realize losses, and use these losses to offset gains from other investments (but ask your CPA first). Our service simplifies this process, helping you offload junk from your wallet as part of your crypto tax strategy.

Need a Tax Pro?

Tax rules vary worldwide, so always consult with a professional. We recommend the crypto-native tax pros at WAGMI.Tax, who have handled our taxes for years.

Visit WAGMI.TaxFollow your friends to see who has used Harvest before.

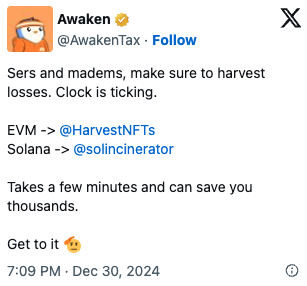

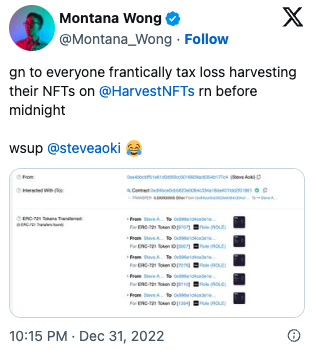

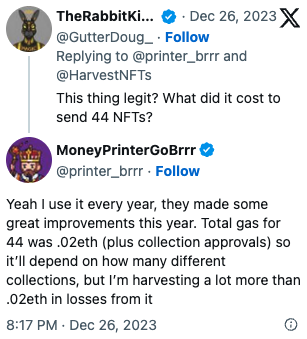

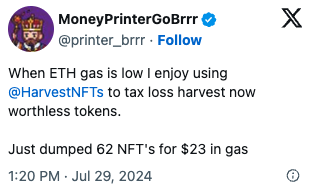

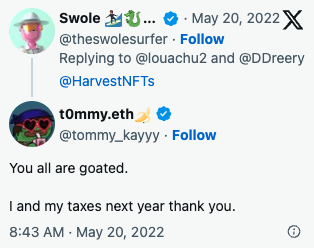

What People Are Saying

Join thousands of happy harvesters